Non-Profit Accounting in El Paso, TX

Tax-exempt and General Accounting Questions Answered by a Top CPA Firm

Non-Profit Accounting Specialists

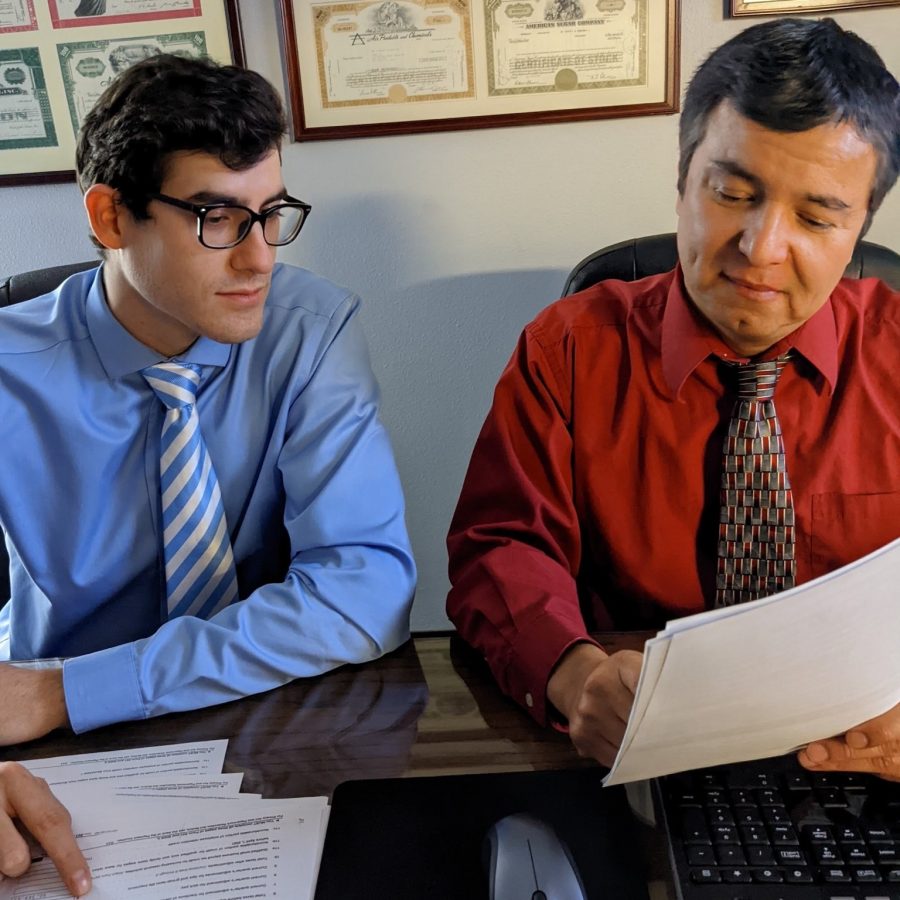

Our El Paso-based accounting firm salutes those of you who work in the non-profit sector. You are a valuable resource for our community, and your work benefits society.

Volunteerism is a hallmark of Marcus, Fairall, Bristol + Co., PLLC. Our community-oriented partners at Marcus Fairall, Bristol + Co, PLLC are active volunteers in the local community, and we encourage our staff to become involved in their favorite non-profit.

If you have been involved in the non-profit world for any length of time in El Paso, you are almost certain to have met one of our professional accountants. As specialists in non-profit accounting, they assist the non-profit organization in filing for tax-exempt status and setting up the required accounting systems, including helping the agency with the appropriate reporting and disclosure policies.

File for Tax-Exempt Status

Tax-exempt refers to net income and profits free from tax at the federal, state, or local level. Non-profit organizations are exempt from many taxes. Therefore, the agencies must maintain careful records to show compliance with federal requirements.

Other than by way of legitimate salaries, they cannot pass profits on to directors or members of the organization. To receive the tax benefits of a non-profit entity, an organization must first apply for tax-free status. (This means the entity wishing to be tax-exempt must apply for non-profit status with the IRS).

Tax-exempt status comes with a host of reporting requirements that must be met. We’ll set up your reporting, bookkeeping, and payroll systems, and we can assist in preparing your organization’s formation documents.

To learn more about non-profit accounting in El Paso, contact us via email at info@marcfair.com or call us at (915) 775-1040.

Accounting for the Not-for-Profit Organization

If you’re starting a new non-profit organization, we can help you prepare your organization’s 501 (c)(3) application for tax-exempt status.

Here’s what’s needed…

- Articles of Incorporation containing the Exempt Purpose Statement as described in IRS Code section 501(c)(3) and defined in Treasury Regulation 1.501(c)(3)-1 Paragraph d and the Dissolution Statement described in Treasury Regulation 1.501(c)(3)-1 Paragraph b subparagraph 4 (“Organizational Test”)

- Employer Identification Number

- Organization By-Laws

- Minutes of Board Meetings

- Names, Addresses, and Resumes of Board Members

- Names and addresses of all Active Members

- Inventory of Assets like cash, furniture, equipment, property, pledge, etc.

- Inventory of Liabilities like mortgages, accounts payable, loans, etc.

- Rent/Lease Agreements and Contracts

- Revenue and Expense Statement for the last four years or as far back as possible if your organization has existed for less than four years.

- Written Reason for Formation and History of the Organization

- Organization Mission Statement or Statement of Faith or Beliefs for Churches and Other Religious Organizations

- Organization Activities, Operations, and Programs Documentation, including your statement of purpose & operations, food programs, fundraisers, flyers/brochures/pamphlets, etc.

- Financial Support Documentation, including all sources of revenue like contributions, tithes, offerings, fundraisers…

- Fund Raising Program Descriptions

- IRS Processing/Filing Fee

If you have questions or would like to learn more about non-profit accounting services in El Paso and surrounding areas, or our other tax planning and preparation services, please call (915) 775-1040 or contact us online.

TESTIMONIALS

Have any financial questions?

Should you need any help related to non-profit accounting please don’t hesitate to reach out to one of our CPAs and we’ll get you the right information and advice to ensure you make the right decisions! Call (915) 775-1040 for immediate assistance!

MARCUS, FAIRALL, BRISTOL + CO., PLLC

230 Thunderbird Dr Ste G, El Paso, TX 79912

Phone: (915) 775- 1040

Full-Service CPA Firm in El Paso

Need help resolving tax problems?

If you owe back taxes, have received an IRS notice or are already experiencing a lien, levy, wage garnishment or other tax problem, take a positive step on putting an end to your tax problems. Call us today and we will provide you with a tax resolution expert to help you out.